REITs as an alternative source of hospitality liquidity

This is the first of a two-part look at this subject. Be sure to check out the conclusion in the August issue.

The current real estate market is difficult to forecast, as most “crystal balls” are blurry, and many of the key economic indicators point in too many directions. However, whether you’re anticipating a bull or bear scenario, the current market promises to reward prudence, diversification, opportunistic buying, and innovation. In fact, most investors are currently in a wait-and-see mindset, and well capitalized investors are in a strong position for opportunistic buying.

After a healthy 10-year run of low-cost money, interest rates are now up, consumer confidence is down, and banks – especially regional banks – are under intense pressure to tighten up lending standards. While inflation has fallen since its peak, it still exceeds historical norms, and consumer debt levels have continued to rise, savings rates still lag historical averages, and home affordability continues to be a concern.

Construction costs, having come down moderately, are still elevated enough that some developments don’t yet paper, resulting in lower-than-normal supply growth. Recent bank failures will complicate the acquisitions, refinancing, and property improvement plans due to a tighter lending environment. Regional and small banks continue to lose deposits, which will lead to decreased lending in the hospitality sector. Consumer credit across the board is at a concerning level, thereby creating downward pressure on consumer spending and tourism. While the Federal Reserve is nearing its inflation target, it likely will hold interest rates at these elevated levels for the near future.

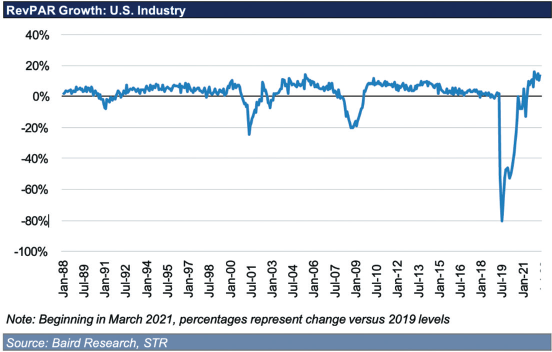

Finally, the COVID-19 pandemic had a devastating impact on the global hotel industry, which has seen a significant decline in occupancy rates and revenue. In fact, as seen in the accompanying chart, the weighted-average RevPar across all markets, adjusted for inflation, is still behind its benchmark when chained to Q1 2016 RevPar figures.

As can be seen in the below chart, the COVID-19 impact on RevPAR was four times – yes, 4X – greater than any previous demand shock. All cycles end differently, but the big REVPAR draw-downs are usually caused by demand shocks. And according to Baird Research, “we expect ‘growth’ to remain a headwind in 2023, particularly on the bottom line as expenses normalize and outpace the top line.”

So far, in the CMBS universe from January through March of 2023, there have been more than $3.7 billion in new maturity defaults with loans failing to pay off on a timely basis. Further, the aggregate amount of CMBS debt in maturity default has increased by approximately 28% during the past 12 months.

So far, in the CMBS universe from January through March of 2023, there have been more than $3.7 billion in new maturity defaults with loans failing to pay off on a timely basis. Further, the aggregate amount of CMBS debt in maturity default has increased by approximately 28% during the past 12 months.

Given all these rosy indicators, how does an owner of real estate – specifically, hospitality assets – secure liquidity and salvage underperforming properties, with more than $162 billion of loan maturities approaching in 2023, according to CRED iQ?

TRADITIONAL LIQUIDITY OPTIONS

There are a number of traditional options that are readily available for hotel owners to secure capital ranging from raising equity capital, senior debt, subordinated debt, preferred equity, equipment leases, etc., etc. Each of these sources of capital have a different place on the capital stack, and each has its own benefits, costs, and detriments.

The No. 1 question being asked today from investors has been, “How does the financing backdrop and impact on local/regional banks affect hotel financing?” The silver lining – if you could find one in these tumultuous times – is debt capital for hotels wasn’t widely available or attractively priced before the recent capital markets volatility, so the impact on hotel lending might not be as bad as feared, relatively speaking.

In fact, 67% of outstanding commercial real estate loans (by $) were held by small- and medium-sized U.S. banks (nontop 25 financial institutions), according to the Federal Reserve. The advantage of banks and SBA lenders, which typically are regional or community banks and credit unions, is they usually offer low interest rates, long repayment terms, and large loan amounts. Yet, to qualify, you’ll generally need a strong credit history, solid financials, and multiple years in business.

Welcome to the convergence of temporary under-performing assets, dampened valuations, less than stellar financials, tighter lending conditions, a reduced pool of buyers and $162 billion in loan maturities occurring within the next year. In short, these are some interesting times!

In response, hotel owners are exploring various strategies to secure liquidity and stay afloat. One of the often-overlooked strategies being adopted by hotel owners is to roll up their hotels into real estate investment trusts (REITs).

In next month’s conclusion to this article series, we’ll examine a few additional means by which property owners can secure liquidity and salvage underperforming properties given the current challenging economic times in which we find ourselves.

Ken Patel

Ken Patel