Laddering fixed-income securities for hotel reserve accounts

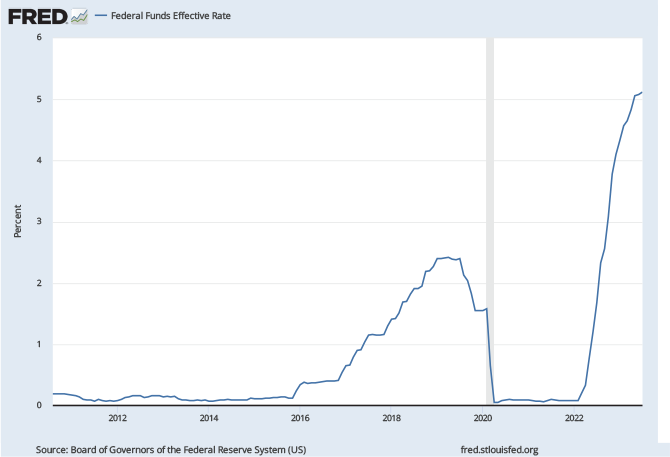

The dramatic rise in interest rates during the past two years has been hard to miss, but many hoteliers are just now beginning to grapple with the implications of the shift. The low interest rates of the past 20 years have allowed operators to use less financial discipline, simply borrowing when needed. However, the era of extremely low interest rates appears to be over. Borrowing costs for purchase, refinance, or renovation have doubled. This shift presents new risks for those who are debt dependent and presents new opportunities for those who are financially disciplined.

GET IN THE DRIVER’S SEAT

With higher rates, existing operators with fixed-rate debt may face significant financing risk and not yet realize it. Without adequate planning for necessary improvements, existing operators could be forced to borrow at these high rates, significantly impacting cash flow and profitability. Consider for example your next franchise property improvement plan (PIP). These investments require significant capital investment ranging $500,000 to $5,000,000 every 5 to 15 years. Historically, many operators simply borrowed these funds and low rates made this strategy viable. However, if financing the next PIP now costs twice as much, operators could be faced with a significant hit to cash flow. Worse, some operators may simply be priced out of their franchise, forcing them into a lower tier flag that cannot command the same volumes of revenue.

KNOW YOUR TIME HORIZON

Operators who recognize the interest rate shift now, before the required PIP, can take control of their future by establishing a reserve account over time. A reserve account puts the operator in control by providing a pool of funds for the PIP. The operator can decide whether to proceed with the PIP based on the actual revenue of the property, not just the financing costs. The reserve also improves the creditworthiness of the entity and can position operators to obtain more favorable lending terms if borrowing is needed for other deals they pursue. Most importantly, a reserve avoids a dramatic, unexpected drop in cash flow.

Thankfully, higher interest rates also reward those who plan ahead. Safer assets such as U.S. Treasury Bonds, investment grade corporate bonds, municipal bonds, CDs, and even money market accounts are paying the highest yields in more than a decade. For example, as of this writing U.S. 6-Month Treasury Bond yields are more than 5.4%.

BUILDING HOTEL RESERVE ACCOUNTS

Most advisors recommend setting aside 4% of annual gross revenue as a reserve for capital expenditures. Consider making periodic (e.g., quarterly) contributions to the reserve. Funds should be invested in a conservative portfolio of bonds targeted to mature when needed, locking in the yield until maturity. As the reserve grows, the interest income will compound, providing an accelerating income against the original investment. Compounding has been hailed by many investors as the cornerstone of success.

For example, investing $25,000 per quarter for 10 years at a 5% interest rate would grow to a total of $1,287,238 with an investment of $1,000,000.

Cedarstone Advisors has found success with the following plan for a hotel reserve account. After making your quarterly transient occupancy tax payment, transfer 4% of your gross revenue to a dedicated brokerage account. Use your brokerage account to allocate your funds into fixed-income securities with the best possible yield available based on your time horizon and risk parameters. This also gives you an opportunity to confidently make a cash distribution if you have excess cash in your checking account. Purchasing a one-year CD with a 5.0% APY could be great for the next 12 months, but it’s fully taxable and will inevitably be subject to reinvestment risk at a lower rate if and when the Federal Reserve lowers rates. A U.S. five-year treasury note yielding 4.25% for the next 60 months offers tax benefits and could help maximize on your cash if it suits your time horizon. Or consider a 10-year corporate (A) bond with a yield to maturity near 6%.

Many operators will need to rediscover financial discipline or become a victim of the new, higher financing costs. Those who plan ahead will be rewarded with strategic flexibility, opening opportunities for investment. Those who fail to recognize the change in financing costs may suddenly find themselves with limited options.

Steve Coker

Steve Coker Sunil Lad

Sunil Lad